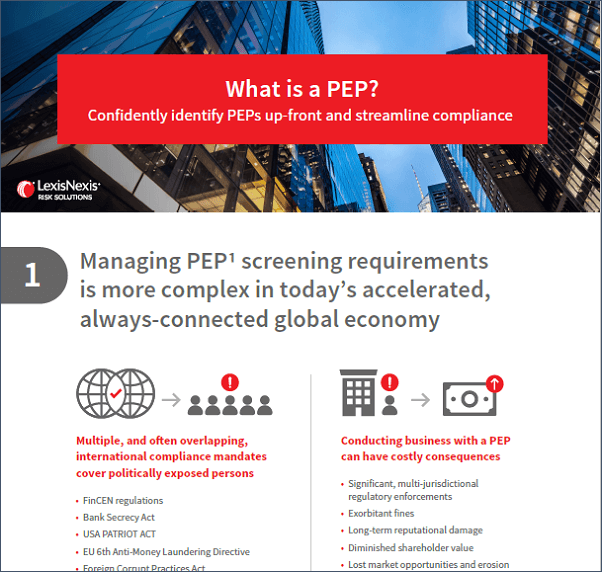

In order to ensure your organization fully complies with financial crime compliance regulations, it is essential that you and your team are aware of who or what a Politically Exposed Person (PEP) could potentially be, in order to identify them and carry out enhanced due diligence procedures.

Providing a definitive list of who could be classed as a PEP is difficult, as the criteria is so broad; international definitions vary and the Financial Action Task Force (FATF) is frequently issuing updated recommendations.

In basic terms, a Politically Exposed Person is someone who, through their prominent position or influence, is more susceptible to being involved in bribery or corruption.

Providing a definitive list of who could be classed as a PEP is difficult, as the criteria is so broad; international definitions vary and the Financial Action Task Force (FATF) is frequently issuing updated recommendations.

In basic terms, a Politically Exposed Person is someone who, through their prominent position or influence, is more susceptible to being involved in bribery or corruption.

In addition, any close business associate or family member of such a person will also be deemed as being a risk, and therefore could also be added to the PEP list.

The Basic Criteria for Deciding Who Is a Politically Exposed Person

Anyone in any of the following roles should be considered a potential PEP.

PEPs in Government Roles

- Legislative Bodies: An example is a Member of Parliament

- Executive Bodies: A PEP could range from the head of state down to the assistant ministers

- Diplomatic Roles: Ambassadors or chargé d’affaires would be considered PEPs

- Judiciary Bodies: Key people working within supreme courts, constitutional courts or high-level judicial bodies

- State-Owned Enterprises: A PEP would typically be anyone from a senior executive upwards. However, even former members of the board of directors no longer associated with an organization may retain influence and still be flagged as PEPs

PEPs in Organizations and Institutions

- Central Financial Institutions: Examples here would be the Court of Auditors and members on the boards of central banks

- Armed Forces: In this situation a PEP rating would typically only apply to a high-ranking officer

- International Sports Committees: Members of these committees may be influenced to vote on the location of major sporting events/contracts for building venues, etc., so have recently been included by FATF under their definition of a PEP

Known ‘Close Associates’ who are Considered PEPs

- Anyone with a close business relationship or joint beneficial ownership of legal entities or legal arrangements with a PEP

- Anyone who has the sole beneficial ownership of a legal entity which is known to have been set up for the benefit de facto of the PEP

Immediate Family Members who are Considered PEPs

- Parents and children of PEPs

- Spouse or partner

- Siblings

- Uncles and aunts

- Even slightly indirect family members (such as in-laws) will be considered as politically exposed persons

Note: Each country may have different local PEP regulations that you need to comply with when doing business in that region.

Test Yourself: Are these people PEPs?

- The mayor of Paris

- A former member of the board of directors for a state-owned enterprise

- A famous actress

- Head of the Olympic Committee

- The son-in-law of the mayor of Paris

- A town councilor

- The justice of the peace in a Magistrates Court

- The manager of a national football team

- The business partner of someone who has a sister on the Olympic Committee

How To Easily Identify These PEPs

It’s easy to see how the list of potential PEPs is expansive and continually in flux as people move into new roles, family members change, regulations and recommendations from the FATF are updated at the local level, and the international landscape changes.

Contact us to learn how to streamline your due diligence and lower your exposure to risk and fines.